Why we want Google to step up

Indago's Founder and Managing Director, Gary Nissim was recently interviewed for The Australian. You can read the full article here.

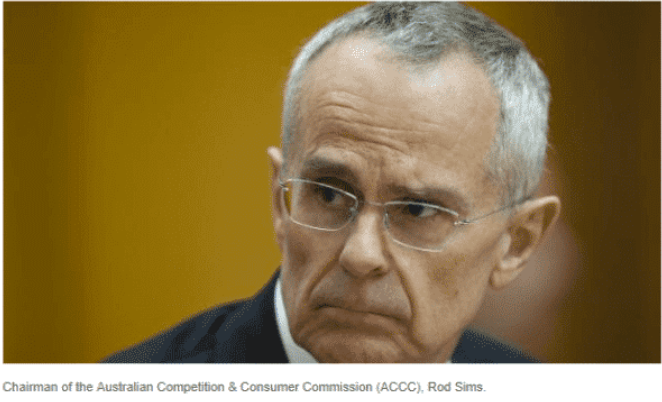

Google is facing increased pressure from Australia’s advertising industry to be more transparent about its operations, with competition boss Rod Sims urging advertisers to come forward as part of a probe into the company’s outsized role in the supply chain.

“We need certain checks and balances,” Gary Nissim told The Australian.

Gary Nissim, founder and managing director of Indago Digital, said he had a problem with the fact that media was being optimised and the success measured by the same company he was buying that media from.

Mr Nissim said that while Google had benefited marketing in general, there were still a lot of unknowns about how the company’s algorithms were set and how the cost per click was calculated.

That challenges agencies like Indago, a Sydney-based independent specialist search agency and one of the fastest growing in Australia.

A “Google Premier Partner”, it has a high spend with Google across not just search but display, video, in-app, mobile and through Gmail-sponsored promotion.

“In search, we pay on a cost-per-click model in a closed auction and with an algorithm that determines our final price,” Mr Nissim said.

“Why would the price of your click increase when the amount of advertisers in a certain vertical drops and consumers searching in that vertical increase?

“I’m not intimating that Google games the algorithm to generate more revenue, but surely they have that ability. I’m also not saying that the Colonel’s secret recipe — the algorithm — needs to be public, but certain checks and measures would be ideal.”

Australian Competition & Consumer Commission chairman Rod Sims said he was concerned with the pricing transparency of ad-tech giants such as Google that hoover up the vast majority of advertising dollars at the expense of homegrown players.

“It is important that we better understand the issues with the ad tech supply chain because a lack of transparency means advertisers do not know what they are paying for, where their advertisements are being displayed, and to whom,” he told the ThinkTV conference in Sydney.

“Higher advertising prices ultimately translate to higher consumer prices for products and services.”

He said the “cut” of ad spending taken by ad-tech intermediaries is estimated to be between 30 and 75 per cent of the final price paid and that it was possible that less than 50c in the $1 paid goes to delivered advertising.

Mr Sims also said online media businesses and advertisers were potentially being disadvantaged by Google’s market dominance.

“We have not yet reached a view on these issues, and we are continuing to examine the ad tech supply chain to understand better how it works and how this impacts advertisers,” he said.

“In this, we would like the advertising industry’s help, as it is clear these are issues that require close examination.

“There are different examples of this vertical integration and opportunity to discriminate in the delivery of online advertising, particularly across the programmatic advertising supply chain.”

According to Mr Nissim, Google’s innovations in the 1990s cemented its current position of market dominance.

In Google’s submission to the ACCC, the company’s local boss, Mel de Silva, said Australian platforms such as Seek, Domain and REA were also to blame for journalism’s loss of advertising revenue.

“From an advertising perspective, search advertising is just one of many channels advertisers invest in and we compete directly for advertising dollars with other digital channels, as well as television, print, radio and outdoor advertising,” she said.

Written by

Indago Digital